Market Updates | 2nd October 2020

We're all facing unprecedented challenges which will continue in the next few weeks and months in our daily lives, in our communities, and in our businesses. But we've also seen evidence of how, when people work together, they can make a difference. It's in that spirit of collaboration that we've been publishing regular updates and forecast data around the performance of the consulting market in 2020.

Our forecasts are constantly updated to reflect the latest market data we have available from consulting firms and clients. They're not intended to be a one-off, static roadmap, but rather a guide to the rapidly changing conditions in the market. Like satnav or a GPS navigator, we're constantly monitoring the route ahead and that's why our numbers change. We think that the speed with which consulting firms adapt their services to the current crisis will be critical, and that this is the best way to help them do so.

Summary: 2nd October

Small gains in some markets are encouraging but, with almost half the global consulting industry in the US, the continued fragility of this market remains a cause for concern. Clients who, in the last month, have showed signs of making decisions they'd deferred earlier in the crisis and of appreciating the need to adapt to a prolonged crisis, may put initiatives back on hold.

Will the wind change direction?

There's less talk in business these days about first wave, second wave, etc., and more of a recognition that this crisis is a continuous sequence of multiple, overlapping waves. Rather than being able to see distinct changes approaching from a distance, the consulting industry and its clients are being buffeted by an endless procession of small and large waves. They are—as we noted in our last update—having to adapt to that environment, but those conditions can make it harder to see if the wind is changing direction.

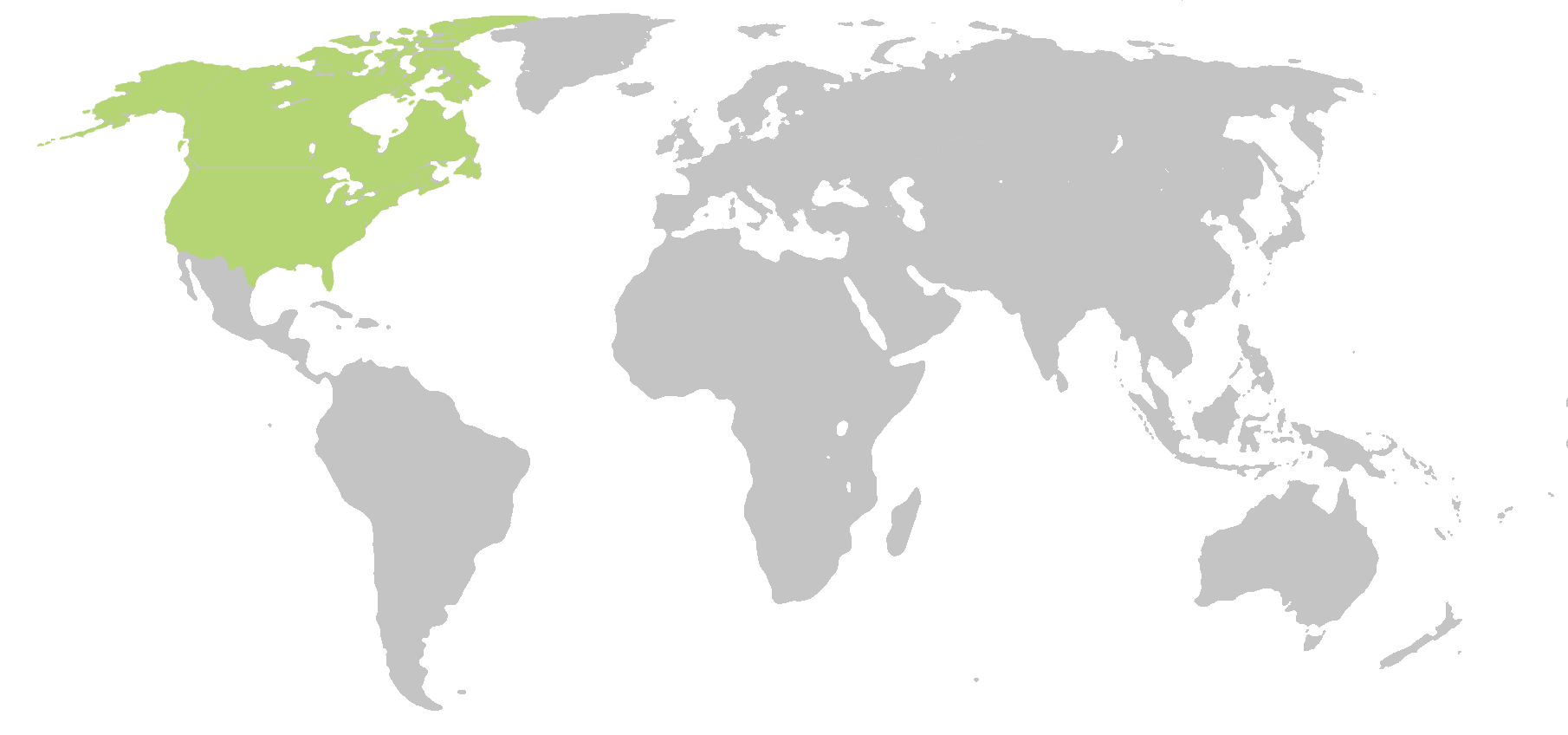

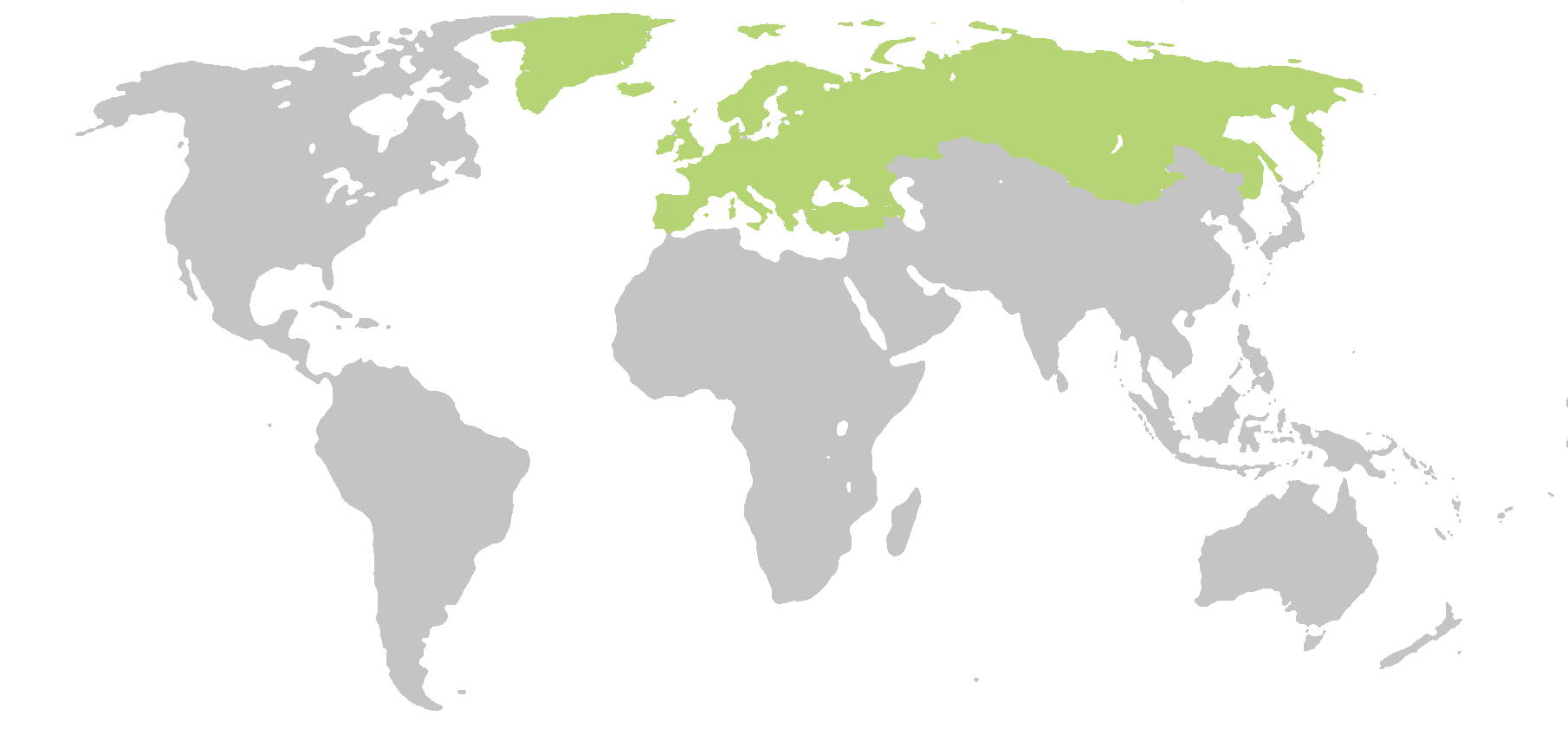

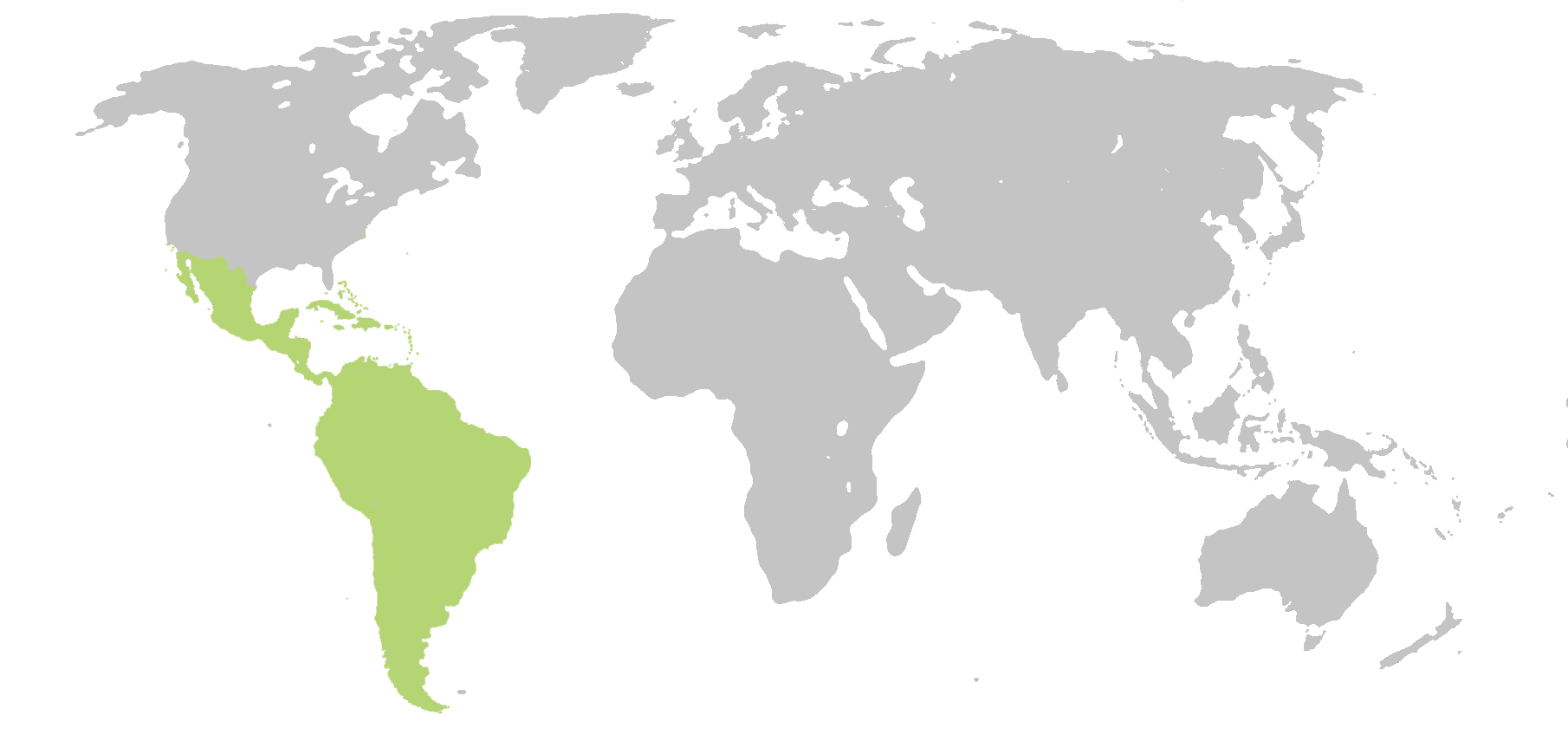

First the good news. Although our overall forecast for this calendar year remains a 14% contraction in the global consulting industry compared to 2019, the prognosis for some markets is improving. Europe continues to make gains: We're now predicting that this market will shrink by 12% this year, an improvement of one percentage point since our last update. We also see improvements in Africa and Central & South America, partly linked to a slightly more positive picture in the energy & resources sector.

| Region | 2019 (US$bn) | 2020 forecast (US$bn) | % change | |

|---|---|---|---|---|

|

North America | 77.6 | 66.1 | (15%)- |

|

Europe | 43.1 | 37.8 | (12%)↑ |

|

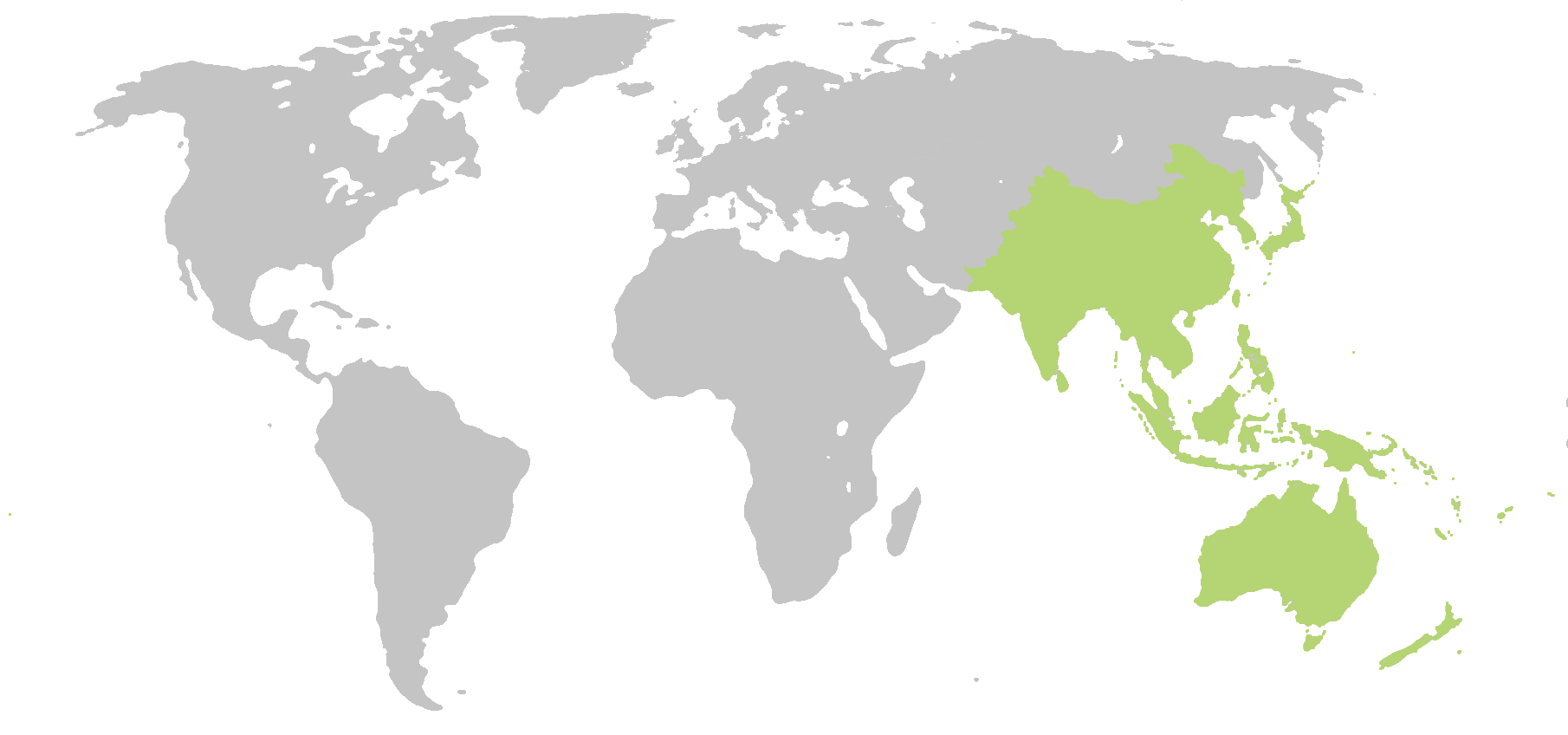

Asia Pacific | 24.8 | 22.3 | (10%)- |

|

Central & South America | 5.1 | 3.9 | (22%)↑ |

|

Middle East | 3.7 | 3.1 | (16%)- |

|

Africa | 2.9 | 2.3 | (18%)↑ |

| Total | 157.2 | 135.7 | (14%)- |

The forecasts for strategy and technology—the twin pillars on which rebadged digital transformation projects stand—are also improving. Regular readers of these updates will know that technology has consistently been the strongest-performing service line, so the improvement of one percentage point we see in its forecast takes us to a contraction of just 4% for the year as a whole. There's much more ground to make up where strategy consulting is concerned, but the improvement of one percentage point this week comes on top of 13 weeks in which our forecast remained steady or improved. It's worth noting, too, that part of the change for the better in Europe stems from an improving prognosis for Germany, where we think the consulting market will shrink by only 10% in 2020. Germany is not only the biggest consulting market in Europe but also has a larger-than-average strategy market.

| Services | 2020 forecast % change |

|

|---|---|---|

|

Financial management | (26%)- |

|

HR & change management | (29%)- |

|

Operational improvement | (17%)- |

|

Risk & regulatory | (12%)- |

|

Strategy | (20%)↑ |

|

Technology | (4%)- |

| Total | (14%)- |

And now the bad news, which is that despite these positive changes, our forecast for the US remains unchanged. We estimate that the total US market in 2020 will be worth US$62bn, a 15% fall from its 2019 figure of US$73bn. The US technology consulting market (our numbers exclude the much bigger market which includes systems development and integration, and outsourcing) is worth around US$20bn, and we expect it to contract by just 1% this year. However, that figure has remained unchanged for weeks, even while it's improved in other parts of the world. One important consequence of this is that technology consulting as a proportion of the total US market is rising—we estimate from 28% last year to 32% now—making it an even more important part of the US consulting market. But the fact that this demand isn't picking up is also testimony to the uncertainty that bedevils this geography. With infection rates rising in many states and an already fraught presidential election race now complicated by the announcement that Donald Trump now has the virus, investors and executive teams could be forgiven for hesitating.

That may sound counterintuitive to consulting firms that are continuing to deliver large-scale projects, but it is reflected in the growing concerns that many firms have around the quality of their pipelines. Clients are pushing prices down, except where deep and scarce expertise is required. Where possible, clients prefer to use their own in-house resources to do most of the work. Project size is typically smaller, with some large projects being broken down into smaller units that allow clients to evaluate the results delivered before progressing on to the next stage. Our research has also highlighted the gulf between clients' underlying need for consulting support, which is at least as strong as it was at the start of this year, and the extent to which that translates—or doesn't—into money spent on consulting services in practice. Closing the gap will depend on developing new services designed to align with clients' most pressing concerns, positioned in a way that resonates with senior executives whose organisations may be fighting for survival.

The key question here is whether the prospects for the consulting industry will get worse during the fourth quarter of the year. Through most of the summer, our forecasts have been slowly but surely improving, which led us to hope that the final figure for this year would prove to be more positive than our earliest predictions. But, as hoped-for improvements in the US seem increasingly unlikely to materialise, and if rising infection rates trigger renewed uncertainty in European consulting markets, it's not impossible that the ground consulting firms have made up in recent months starts to reverse.

Further questions

We've included details of our model and forecasting methodology below. If you'd like to know more about how we've created our forecasts or want to understand how the year is likely to play out at a more granular level for your firm, please contact charis.buckingham@sourceglobalresearch.com.

Methodology

In order to calculate this forecast, we've taken the most recent forecast from our model of the consulting industry, which was prepared pre-crisis, in early January 2020. This unique model is built bottom-up, by estimating the number of people employed by several thousand major and mid-sized firms across 84 countries, 29 industries, and a range of services. We then apply a series of metrics and adjustments around the revenue per consultant. Where possible we validate this data against published sources and interviews with senior people in the firms concerned. Although some of our 10 million individual data points and assumptions may be wrong, when aggregated, they provide a robust view of consulting markets around the world. Moreover, because of the way this model has been built, we can adapt it to take account of new scenarios—as we have done here. In order to understand the likely impact of COVID-19, and the broader evolving market, on the consulting industry, we've developed forecasts at the level of individual service lines, quarter by quarter, then modified these depending on industry and country. Please note that all the data in this bulletin is for the calendar year 2020 and is in US dollars. We've calibrated our assumptions with a number of major and mid-sized firms.

Definitions

One of the greatest challenges with sizing any part of the consulting industry is that "consulting" means different things to different people. Over the last 12 years, Source has adopted a consistent definition, and this underpins all our published material about the consulting industry. It includes traditional management consulting services (strategy, HR & change, operational improvement, risk & regulatory work, and technology consulting), but does not include systems development and integration, and outsourcing services.

Scope

Our model also focuses on what we call "big consulting", work done by consulting firms with more than 50 consultants typically for clients with a turnover in excess of $500m.

About Source Global Research

Source Global Research is the leading provider of research about the professional services market. Founded in 2007, we serve the world's leading professional services firms and their clients with expert analysis, data, and insights. Firms come to us because they know we offer transparency in a notoriously opaque market. We provide direction and evidence about changes in the marketplace, helping firms cut through what can sometimes be intractable discussions around future direction by being objective and honest.

Data sits at the heart of what we do, and our model of the professional services market is the largest and most sophisticated in the world. Data in the model comes from extensive desk research, and interviews with over a thousand senior partners from around the world. It feeds into our customers' business strategies and helps them prepare for the future. We also place a strong emphasis on the views of clients of professional services firms (we conduct some of the largest interviews on this sector in the world) and listen to what clients need, and how their views are changing in the marketplace.

Please note that, because we work with such a wide range of firms, we take confidentiality very seriously. Our ongoing research programme, including interviews, and customised project work with individual firms, gives us an extensive foundation of knowledge and allows us to work on some of the most confidential issues these firms have.

Our independence and knowledge of the professional services industry means that we're trusted to set our work within the wider market context, helping firms make the most of the opportunities on offer. Our customers would tell you that we have a strong commitment to doing the very best for every firm we work with, and are thoughtful, friendly, and easy to work with.